A bill was reintroduced in Albany last week that would revive a proposal to increase a real estate transfer tax in the five East End towns, with the intention of generating revenue to build affordable housing and provide assistance to first-time home buyers.

By adding a 0.5 percent tax on all real estate trades, the Community Housing Fund could work much like the Community Preservation Fund, or CPF, said State Assemblyman Fred W. Thiele Jr., who sponsored the legislation. The CPF, which is fueled by a 2 percent real estate transfer tax, has helped East Hampton, Riverhead, Shelter Island, Southampton and Southold towns purchase more than $1 billion in property and development rights to preserve farmland and open space, create parks, and address water quality issues since its creating in 1999.

Mr. Thiele envisions the Community Housing Fund, or CHF, as “a revolving fund for housing” to make existing housing stock more affordable through town-sponsored loans, and also to help build new structures priced for low-income residents.

“The funding method for the Community Preservation Fund has been an overwhelming success,” Mr. Thiele said. “This will be similar, with some divergence, too. I think that as people look to tackle the issue of affordable housing, there is no silver bullet that is going to resolve the affordable housing process … This will be another tool in the toolbox. And, right now, there are very few tools.”

The need for affordable housing on the South Fork has been recognized for decades. In 1999, the year the CPF was adopted, the Long Island Regional Planning Council recommended that East Hampton and Southampton towns significantly expand their residential offerings while balancing the need for land preservation.

However, said Tom Ruhle, East Hampton Town’s director of housing, land that might have been used for affordable housing has largely been scooped up and preserved by the towns using the CPF. At the same time, funding for affordable housing projects can be as scarce as the land itself—making the idea for the new revenue source a good step.

“We need to counter the CPF with just a little bit of funding to keep year-round affordable housing here,” Mr. Ruhle said. “The middle class cannot afford to live in East Hampton, as the CPF has made the value of land here jump.”

Mr. Ruhle estimates that East Hampton Town needs more than 750 affordable housing units and rentals. In Southampton Town, more than 1,000 people are on the town’s affordable housing registry, said Diana Weir, the town’s director of housing and community development.

“We need to make sure that there is enough flexibility in the law in place to give us what we need,” Ms. Weir said.

Mr. Thiele noted that the market for second, third, even fourth homes drives up prices “so high so that those who want to own a first home cannot compete.” He also referenced a strong “not in my backyard,” or NIMBY, sentiment on the East End.

“Everyone wants to live next to a reserve,” he said. “Not sure they can say the same about an affordable housing complex across the street.”

Last year, the bill failed to advance past the legislature, which Mr. Thiele attributes to anti-transfer-tax lobbying, stalling efforts in a Republican-controlled State Senate. But now, with a Democratic majority in Albany, he is optimistic that a referendum could be authorized to go before East End voters.

“To be fair, we introduced this bill a year ago, solely with the purpose of studying,” Mr. Thiele said. “There was no intent on trying to move it. It really was to put a proposal out there and start meeting with interested parties and stakeholders, with the idea of developing a bill for this year. That was a lesson learned with the CPF 20 years ago.”

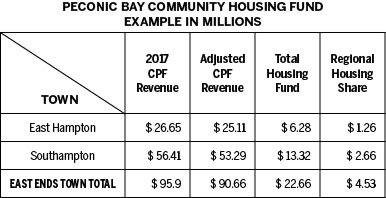

If approved, the CHF is expected to generate more than $20 million per year, with Southampton and East Hampton towns garnering more than $13 million and $6 million, respectively, based on an analysis of 2017 CPF revenues.

An advisory board made up of builders, real estate brokers, bankers and housing advocates in each town would recommend to officials how that money could be used under a community housing plan, which would strategize where housing would be best suited and maintain low-income housing in perpetuity.

All together, the towns would develop a regional housing strategy to coordinate efforts. The regional strategy would gain 20 percent of revenue gained by each of the towns, which is expected to be more than $4 million per year.

The regional real estate transfer tax would be amended to allow homes sold for less than $2 million to be eligible for exemptions. Home buyers would not be taxed on the first $350,000 of the value of a property, which is an increase from the current $250,000 exemption for the CPF.

One idea for using the money to make existing homes more affordable: First-time home buyers would be able to receive a low-interest loan—which would be repaid by the borrower only after the property is resold later—and tax relief from the town for up to 50 percent of the purchase price, which is limited to about $938,000 for a single-family home and $1.2 million for a multifamily home under the State of New York Mortgage Agency.

Eligibility requirements would include about $140,000 for a one- or two-person household and $163,000 for three or more. Those using the CHF would have to residents of the town or working .

“We are not going to build our way out of this,” Mr. Thiele said. “We need people to make the existing housing stock affordable, too.”

The challenge this year will be getting builders, bankers, real estate agents, school districts and communities around village centers—which may already have the infrastructure in place to accommodate more people—on board, Mr. Thiele said. He also pointed out that there is not much vacant land left for large-scale affordable housing projects.

“There will always be that political issue of where will it be,” he said. “If there is political will, this proposal will give towns the funding to make these decisions.”