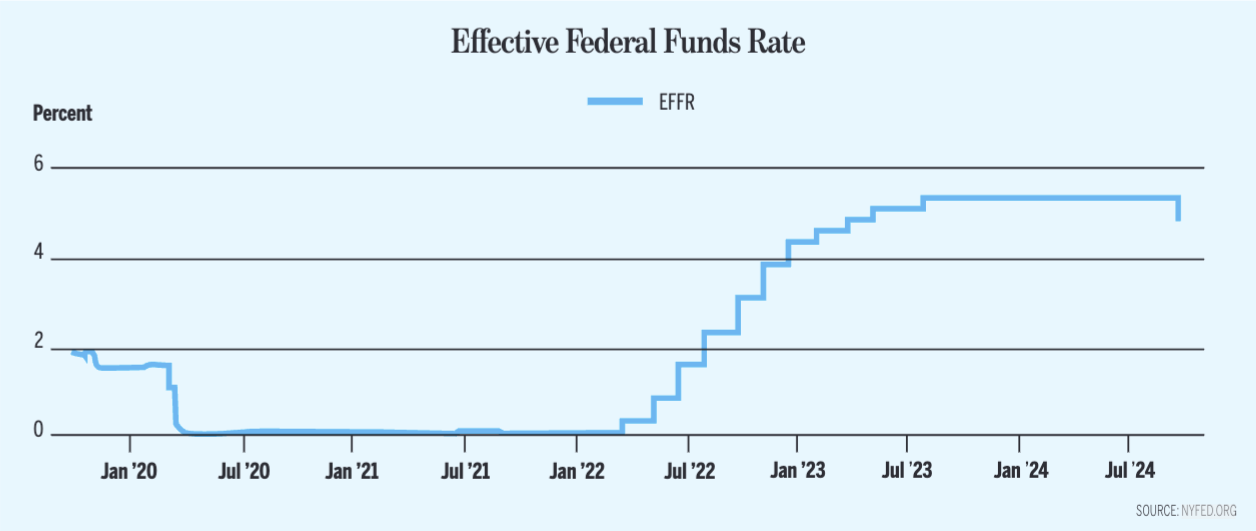

The Federal Reserve’s move last week that lowered interest rates by 50 basis points was the first time it has cut the federal funds rate in four years, and additional cuts are anticipated before year’s end.

Lowering interest rates is likely to encourage growth and stabilize a slowing labor market, potentially extending the current economic cycle. This is largely due to the fact that as Federal Reserve Chairman Jerome Powell noted, inflation is “much closer” to the 2 percent target and the labor market is returning to a less tight but still historically healthy level when compared to the 2019 prepandemic economy.

The Fed reduced the federal funds rate to 4.75 to 5.00 percent in its September meeting, down from 5.25 to 5.50 percent.

It is “time to recalibrate our policy,” Powell said at a press conference after announcing the half-point rate cut, adding that he expects to “continue to see a growing economy, which will support the labor market.”

The 30-year, fixed-rate mortgage (FRM) is now at 6.09 percent as of September 12, down from the prior week when it averaged 6.35 percent. A year ago at this time, the 30-year FRM averaged 7.18 percent. The 15-year FRM averaged 5.27 percent, down from approximately 5.47 percent. In September 2023, the 15-year FRM averaged 6.51 percent.

When considering a mortgage, for each half-percent rate drop, purchasing power rises by about 5 percent. If a borrower was preapproved for a $350,000 property and the interest rate fell by a half point, that buyer can expect buying power to rise by about $17,500. However, lower mortgage rates can also create higher prices.

Lower mortgages are likely to lure more buyers back to the market, bringing in more competition for a limited amount of real estate. Conversely, lower rates could help builders get financing at more competitive rates, increasing the supply of homes for sale.

“We were anticipating a cut, but more significantly, this has buoyed people’s spirits,” said Dawn Watson, a real estate agent with Serhant in Water Mill. “More property had been coming to market, but we’re expecting a blowout. Money will be more available for high-end real estate and luxury goods.”

Southampton-based financial advisor Kevin Luss supports the rate cut and its potential effects on the general economy yet urges patience.

“The housing market can be refueled after the high-interest rate period,” Luss said. “Many had been waiting for something like this. It will also help those interested in refinancing, but it’s going to take a little while before this gets worked into the system.”

Broadly speaking, the Fed is pleased that recent indicators have shown that national economic activity has continued to reliably expand. While employment gains have cooled, the unemployment rate has increased to 4.2 percent nationally and to about 3.8 percent for Long Island, according to the Department of Labor — relatively low by historic standards. Similarly, inflation is hovering around the Fed’s desired target of 2 percent. Combined with lowering petroleum prices, the new lower rate should have an overall stimulative economic impact.

“The real estate industry had been on pause, but there’s no reason to wait any longer,” said Sara Stanich, a wealth advisor in Montauk. “Anyone who was waiting now has their answer. Higher rates tend to strangle the economy. Money will start moving from cash to investments.”

Affordability can remain a hurdle. Nationally, home prices have risen by about 50 percent since early 2020, faster than average household income growth during that period, according to Wells Fargo data.

“This is the eternal Hamptons real estate problem,” Watson said. “People who’ve been waiting get beaten by others with larger down payments. Sometimes even Superman cannot get to contract faster.”

“Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February 2023,” said Sam Khater, Freddie Mac’s chief economist, in a statement earlier this month. He explained that the rates have declined because incoming economic data has steadily been less robust. While the mortgage rate is improving for homebuyers and refinancers, many will likely remain on the sidelines, navigating still-high house prices and low housing supply levels.

“It is important to recognize what this [rate cut] indicates,” said Frank Sorrentino, the CEO of ConnectOne Bank, which has a branch in East Hampton. “It is a recognition that the economy is slowing, not faltering. What it also means is that while the cost of loans may eventually come down, so will high savings rates.”

Bank of America and Wells Fargo have each dropped their prime rate to 8 percent after the Fed’s cut. Banks typically use the federal funds rate plus three percentage points to set their prime rate.

“So far, the Federal Reserve has been very steady in its approach, carefully reading the data and taking the necessary steps to bring inflation down and guide the economy toward a more normalized state,” Sorrentino noted. “Moving forward, it will be crucial to continue monitoring the data closely and determining the best course of action. If the economy continues to slow, additional rate cuts may be considered, but ideally, the goal is for the economy to stabilize while inflation keeps cooling. The recent rate cut signals that we are entering a more stable economic environment.”

Looking ahead, the updated quarterly Dot Plot, a technical indicator used by the Federal Open Market Committee to try to anticipate upcoming policy moves, indicates that a more aggressive path for rate cuts than previously projected is likely. The September median projection is signaling a total 100-basis-point cut by the end of 2024. Some observers predict the Federal Reserve could institute two 25-basis-point cuts, one each at its November and December meetings.

The Dot Plot also signals the federal funds rate will drop to between 3.25 and 3.5 percent by the end of 2025, calling for an additional 100 basis points of cuts. By the end of 2026, newly introduced projections foresee the federal funds rate target dipping to 2.75 to 3 percent.