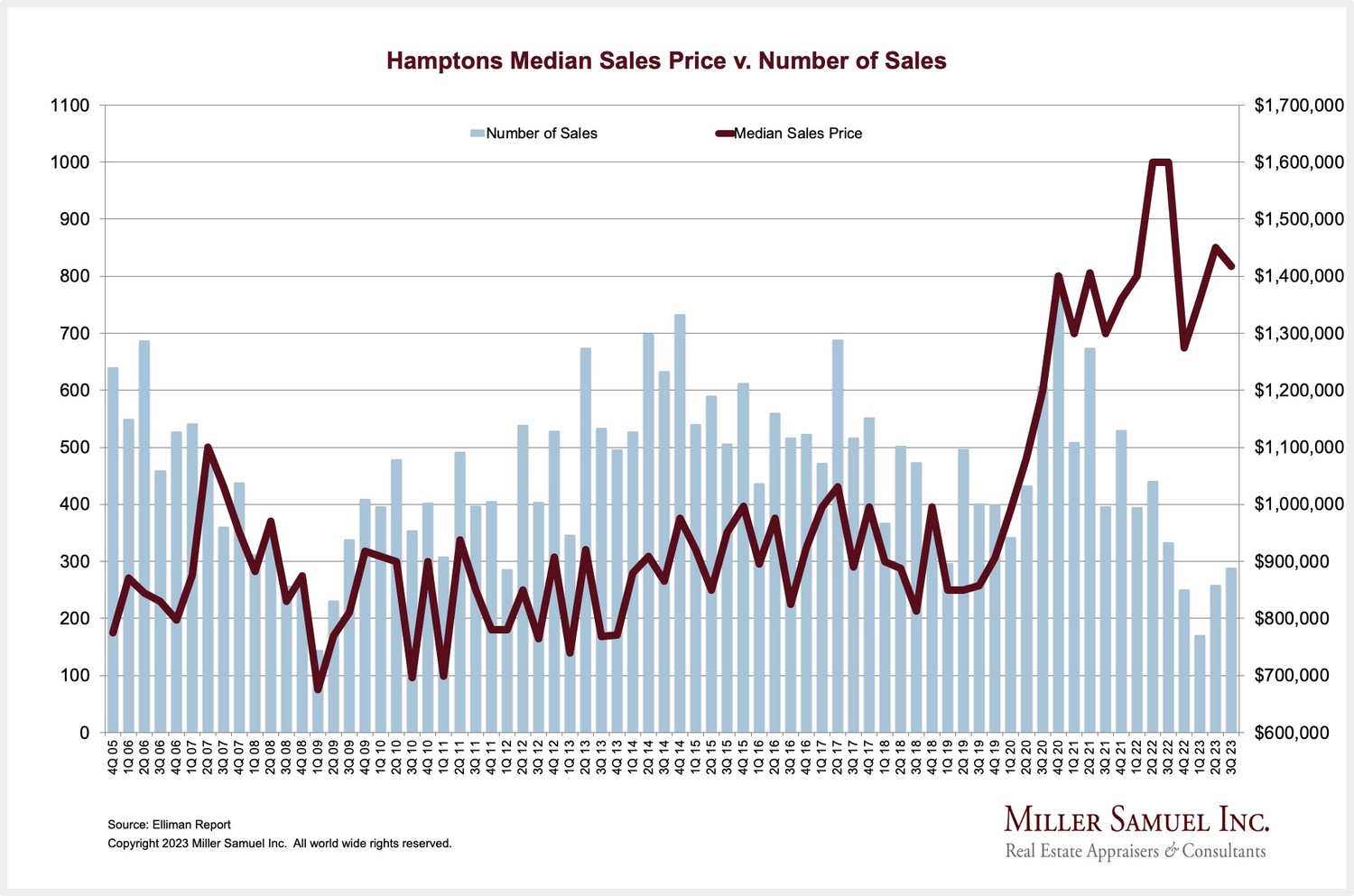

Average and median sales prices for Hamptons single-family homes fell in the third quarter of 2023 compared to a year earlier, but they both remain well above prepandemic levels, according to The Elliman Report.

At the same time, the number of single-family sales fell by 16.8 percent year-over-year, The Elliman Report found, but for just the second time in 18 years of record keeping, sales actually increased between the second quarter and the third quarter.

Jonathan Miller, a real estate appraisal consultant and the author of the Elliman Report, said sales of single-family homes and condos, collectively, typically decline about 15 percent on average from the second quarter to the third. However, in 2023, sales increased 11.6 percent.

What to make of the quarter-to-quarter sales increase, which defies the seasonal nature of the Hamptons real estate market, is unclear.

“In a market full of negatives, it was just interesting to see,” Miller said.

The number of sales is the most important metric on the health of a market, according to Miller, who called it more important than price trends.

The problem in the Hamptons market, he said, is that the single-family housing inventory is still 56.9 percent below what it was in the third quarter of 2019 — the last third quarter prior to the pandemic. It did go up by 3.2 percent, year-over-year, in the third quarter of 2023, bringing it up to 1,056.

The inventory is low, but not low enough to cause prices to rise, Miller noted.

There are still bidding wars going on, which drives the price of some homes above their list price. About one in five home sales, 20.5 percent, was subject to a bidding war in the third quarter. The record high percentage of bidding wars was set in the second quarter of 2022, Miller said, at 36.1 percent.

He advised making comparisons to the prepandemic market rather than contrasting the current state of the market with the surge in activity seen in 2021 and 2022.

“A year to a year and a half ago was the rocket ship of the market,” he said, “and so the problem with comparing against a year ago is these were all-time record prices, and prices are off from those all-time records.

To drill that point home, he noted that the median price of a Hamptons single-family home is 7.4 percent lower than it was a year ago, but still 74.8 percent higher than it was in 2019.

“The market is coming out of this highly distorted data period,” he said.

Effects of Mortgage Rates

Mortgage rates now top 8 percent, the highest they have been since 2000.

“The common explanation for many in the real estate community is ‘high-end buyers pay cash and it doesn’t impact them,’” Miller said. “But that’s not the case.”

He explained that sales in high-end housing markets such as the Hamptons fell for both cash buyers and mortgage buyers. “They just fell more for mortgage buyers,” he added.

It’s not that interest rates don’t affect cash buyers; it’s that rates affect them less than they affect people who are depending on financing.

“Many of the affluent in the Hamptons, even if they pay cash, they’re very aware of the financial markets, and financial markets are impacted by Fed policy,” Miller said. “So it’s incorrect to say they have no impact. It’s correct to say they have less of an impact on the market.”

Economists are projecting rate cuts in the second half of 2024 “but that’s not a sure thing,” he said, adding that the expectation that rates will return to where they were a year and a half ago “is futile.”

“I don’t think we’re going to be talking about 3 to 4 percent mortgages in the near future,” he said. “There isn’t that expectation.”

His expectation is that inventory won’t pour onto the market until there are rate cuts because homeowners with a 3 or 4 percent rate obtained in the last couple of years “are wedded to their rates.”

“That’s part of what is holding back the inventory,” said Todd Bourgard, Douglas Elliman’s CEO of Long Island, the Hamptons and the North Fork. “A lot of times, people like to upgrade, and when they’re upgrading their house, one of the things that they take into consideration is, of course, the mortgage rate that they will be attaining. And a lot of those people now are sitting at 3 and 4 percent. So for them to sell and then buy a home at 8 percent does not make a lot of sense for them right now.”

When rates do eventually come down, whenever that is, existing houses will circulate more.

“There are good things to come,” Bourgard said. “As soon as these mortgage rates begin to trickle down, we will see homes come on the market, and we will get back to what we would consider a very good real estate market.”

And a 30-year mortgage rate is not necessarily a 30-year commitment.

“I’ve been telling people to get married to the property, not the rate,” said Ernie Cervi, Corcoran’s regional senior vice president of the East End, “because as rates change, you can always refinance.”

The Effects of Global Turmoil and Domestic Politics

“There are many negative variables in the world today,” Miller said. “You just had the Middle Eastern tragedy; we have this confusing economic condition where employment is extremely low but everybody feels like the economy is not doing well. It doesn’t prevent people from making decisions, it delays.”

But despite slow decision making and the lack of supply — the difficulty buyers have finding something they want — there are still bidding wars on homes for sale, he pointed out.

“It’s still a difficult market for consumers to navigate, and distractions or adverse global geopolitical events probably added to the calculus of when someone is making a purchase,” he said. “… It’s not a la carte where, you know, this incident pulled back X percent of buyers. I just think it’s created a malaise where consumers are taking longer to make decisions — and that’s being reflected in lower sales activity, combined with that low inventory.”

Because homeowners are holding tight, of the inventory that is on the market, there is a higher share of new construction, according to Miller.

“New construction generally tends to skew higher end, and one of the challenges facing the East End is the lack of affordable housing, and virtually every housing market is going through the same challenge,” he said.

Good Underpinnings

Bourgard sees good things happening in the market and healthy buyer interest.

“We still have so many buyers out here just waiting for the right home to come on the market, and lately we’ve been seeing some more things come on, and those homes are being purchased pretty quickly. So that, to me, is good.”

On whether sellers should expect to get 2021 or 2022 numbers for their homes in terms of the sales price, Bourgard advised “they should expect 2023 numbers.”

“Housing prices stayed very, very strong,” he said. “Those people are getting market value right now, which quite honestly, has us still in a seller’s market.”

While numbers have gone down, they have gone down only marginally, he noted. And when houses are priced properly, they sell pretty quickly, he said. “We are still receiving multiple offers on several of those homes, and when you’re receiving multiple offers, that is the sign of a good market, of a solid market.”

Cervi said there has been a promising uptick in activity and in inventory.

Typically, inventory comes on in September when the summer rental season is over, he said, but this year those listings are coming on the market now — “it’s just been delayed.”

He couldn’t identify a specific reason for the delay, but he said to consider that there are many events happening in the world that cause people to pause before they do anything.

Rental inventory was higher this year, he pointed out, and homeowners who did not successfully rent out their houses may be putting the houses on the market now, he said.

“We typically get inventory that way at the end of the season from rental properties that these landlords just decide they don’t want to be the landlord anymore,” he said. “They just want to move on.”

More Takeaways

“The market is normalizing,” Cervi said. “We came off of this frenetic pace during the pandemic period, and people thought that was normal, and it wasn’t. We’re seeing more of a normalized market, and it’s a little slower.”

The agents are the best barometer, he said: “Are you busy? Are you not busy? And they’re not as busy as they’d like to be. I think that’s going to change.”

The demand is still there, he said, adding that he is confident that as new inventory comes on, the buyers will come out and will purchase. “A lot of buyers have seen what’s available and are waiting,” he said. “… Based on what I’m hearing from our agents, they have buyers, they just haven’t found the right property.”

He acknowledged that the typical Hamptons buying season starts up after the holidays, but he said he often tells people the holiday season is a great time to buy because there is less competition.

“We usually see it slow down between Thanksgiving and New Year’s, and pick up again. Because if people want to be here for the summer, you have to get in a house by February, March to get settled for the summer,” he said.