During the first half of 2022, the Hamptons market achieved record-high prices and record-low inventory, and median and average prices continued to grow, even as inventory began to bounce back.

It was a strong half, but with signs that the pandemic-driven surge in sales is waning and the market is beginning to move toward normalcy. Rate hikes, inflation, a continuing pandemic and economic uncertainty are part of the picture but perhaps not making an overwhelming difference in a market where the housing stock is still historically low and many potential buyers who haven’t found the right fit yet are still home shopping.

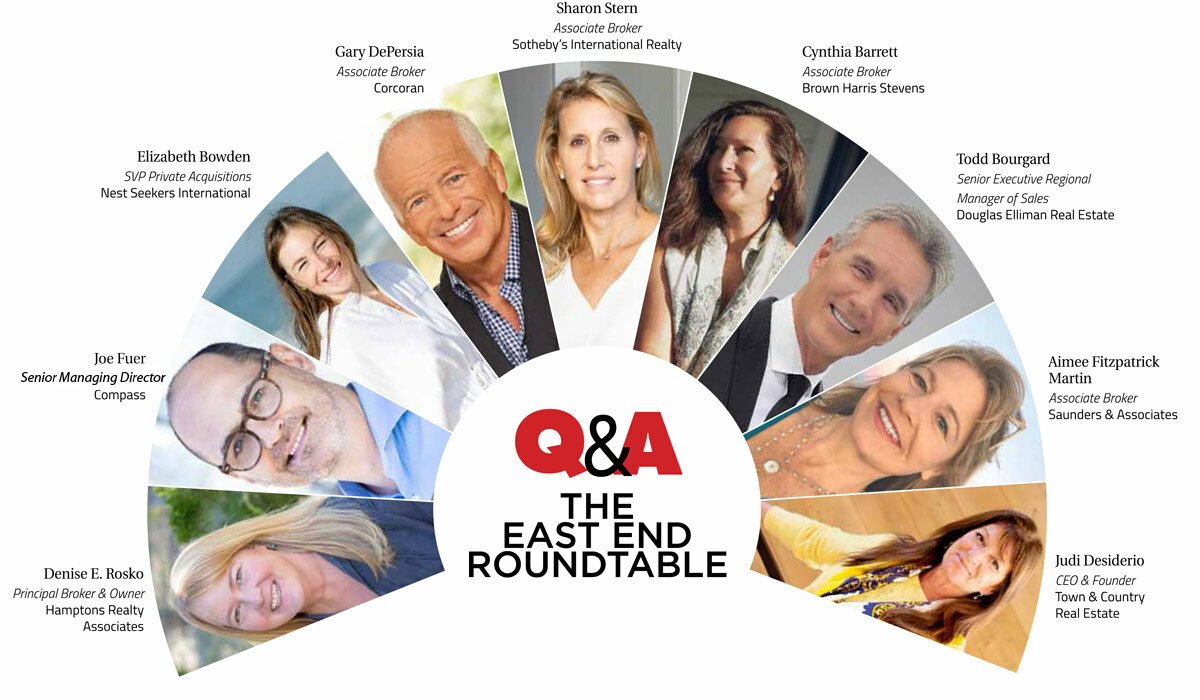

Real estate professionals, from salespeople to managers and brokerage founders, offer their analysis of the year so far and share their expectations for the market going forward.

Entering summer’s final stretch, what is the general mood of the Hamptons market?

Judi Desiderio: The weather this summer has been magnificent, and that’s a good thing. People have been focused on finally getting together with friends and family. The frenetic pace caused by the pandemic has certainly come to an end. There remains some activity — it feels more normal, if you will, but let’s rather call it prepandemic.

Todd Bourgard: As we round the corner into August, the mood remains upbeat and positive. In general, it has been a lively summer season and shows all signs of that vibe continuing.

Sharon Stern: The mood in the market remains largely positive, with buyers still very much interested in owning a home in the Hamptons. Lifestyle, location and long-term value continue to drive buyer sentiment and demand. As the cities return to a new version of normal, many businesses now offer a shorter in-office work week, enabling buyers to use and enjoy their homes far more than they did in the pre-COVID era. As a result, the Hamptons remains a highly desirable destination both for summer and year-round living. Owning a Hamptons home continues to be a sensible investment and lifestyle choice.

Gary DePersia: There’s an optimistic mood. People are still looking to buy, and there seems to be an increase of interesting properties coming on the market. I believe there will be a fair number of deals before the end of the summer.

Denise Rosko: The end of the summer is always one of my favorite times of the year. We find that our summer visitors have had some time to enjoy all that the East End has to offer and find themselves not wanting to leave. With the opportunity to spend time exploring our neighborhoods, villages and beaches, potential buyers can narrow down potential areas of interest. Owning real estate in the Hamptons is always a great investment, and while the rush of COVID purchases may be in the rear-view mirror, the inventory remains low, providing great opportunities for sellers looking for a transition.

Cynthia Barrett: The mood of the Hamptons market has shifted from a frenzied environment to one of stability and consistency and lack of urgency. A more balanced equilibrium, if you will.

Aimee Martin: I think generally upbeat. It’s clear that there’s been a slowdown in market conditions, but the COVID buying frenzy was simply not sustainable. Buyers and sellers are smart and know that. Just like the stock market, what goes up must come down — but then it goes up again. We’re in an evolving, less frenetic market in the Hamptons, but buyers are still enthusiastic, and inventory, thankfully, is slowly increasing. Sales and dollar volume remain strong.

Joe Fuer: There is a return to normalcy, and everyone is feeling it. While inventory is still low and negotiability is exceptionally tight, sellers will not give property away, and buyers will not overpay. Overall, there is a great appreciation for the summer.

Elizabeth Bowden: In the spirit of high season, many are living for today, while others are preparing for the future, both buyers and sellers alike.

What effects have rising mortgage rates and rising interest rates across the board had on homebuyers and sales?

Judi Desiderio: Most of our sales are all cash, or money comes out of some other holdings. Very rarely is a deal subject to a mortgage. That said, it’s all the other extenuating conditions that are affected by rising mortgage rates that makes buyers in general take a pause.

Todd Bourgard: A large percentage of the purchases we see are all cash or with minimal financing; therefore, the rising rates have not yet affected our activity.

Sharon Stern: Homebuyers are all keenly aware of financing costs and are factoring these costs into their offers, but I am not yet seeing a quantifiable impact on the market of the higher mortgage and interest rates. At this point, inventory selection, in my opinion, still remains the most significant factor impacting sales.

Gary DePersia: It’s too early to tell. June is generally a slower month. People have either bought or not bought, and they’re comfortable with those decisions. It’s not until end of July-August when people start coming back to look and make some hard decisions before they leave for the summer. Then, of course, September is also traditionally a very active month. So I don’t think we’re going to know for a while in what direction our market is going.

Denise Rosko: The Hamptons has widely been known as a playground for the rich and famous. An escape from the city, a trip to the country, a beach getaway if you will. Many of the homes are sold to second-home buyers, who may not need to rely on mortgage money for purchasing. Those who do need a mortgage still feel the rates are lower than they were in past years. There are many mortgage programs available, making it easy to find one that fits their needs.

Cynthia Barrett: “Cautious” is the word I would use to describe market sentiment. The Hamptons has historically had a large portion of cash buyers. During the low-interest-rate market, cash buyers opted to engage in financing, as it was cheap money to free up cash for other investments and liquidity. These same buyers have now reverted back to purchasing with cash. Those buyers requiring a mortgage are more cautious about purchasing, although with New York City’s lack of rental inventory and soaring rental prices, a Hamptons home is and will continue to be a safe haven investment. There are mortgage products — Jumbo mortgages, five-, seven-, 10-year interest-only and adjustable mortgages — that currently range in the 3s and 4s. Historically, since 1971, the 30-year fixed-rate average is 7.77 percent, so interest rates hovering just above 5 percent are still low and a good opportunity, comparatively.

Aimee Martin: There are still plenty of buyers out there. Ask any agent and they’ll tell you they have a list of buyers they’re working with who are ready, willing and able to buy a home. They’re just not interested in overpaying for a home, so they’re willing to wait for the right property to enter the market. The expectation is that more housing inventory will come on the market in the fall. With demand still exceeding supply, the buyers expecting big price reductions may be disappointed. On the mortgage front, there are still plenty of good mortgage products out there, and buyers are still able to get good mortgage rates.

Joe Fuer: The Hamptons is a unique place with many all-cash buyers. As such, it is not as heavily impacted by rising mortgage and interest rates as other markets. In addition, our median price point is around $1.85 million, and jumbo loans today are hovering around 4.375 percent — the latter is historically very decent.

Elizabeth Bowden: Real estate is local. While macro charts tend to generalize price points and geographies, bear in mind that not all markets are created equal. Rising mortgage and interest rates create budgets shifts; however, this particular consumer demographic remains bullish. Despite this marketplace crying, much of my customers and clientele are buying.

How is inflation influencing the market?

Judi Desiderio: This certainly is on everyone’s mind. The $100 million question is: Are we in a recession? How long will inflation stay this high? How long will the geopolitical strains continue, and when will life feel normal again?

Todd Bourgard: With inflation affecting everything across the board — rising housing prices along with goods, services, gas, travel, etc. — the buyers and sellers in our immediate marketplace have adjusted accordingly.

Sharon Stern: The effect of inflation is felt by us all, but I am not finding that it is having a direct or obvious market effect at this point. There are larger life issues at play as buyers and sellers make their real estate decisions. Furthermore, buyers want a second home in their asset portfolio, both as a hedge against inflation and as a place to go in times of uncertainty.

Gary DePersia: Too early to tell. See above.

Denise Rosko: The Hamptons has typically insulated itself from the fluctuations in the market, more so than in other areas of the country. Not that it doesn’t hit us, it just seems to hit a little later. That said, the flurry of sales resulting from COVID has dramatically driven up the value of the home prices. Where, in the past, we were seeing entry-level purchases in the $1 million to $2 million as a norm, the new entry-level homes are in the $3 million to $4 million range.

Cynthia Barrett: Buyers and sellers have been pinched by higher inflation in their daily living. Food, gas and supplies have jumped exponentially recently. The total effect in the East End real estate market is that the listing prices have leveled off or plateaued, and price reductions are more common. These factors are offsetting other cost-of-living increases for a potential buyer.

Aimee Martin: If anything, I think sellers who embraced aspirational pricing over the last two years when listing their home — and getting it — are now realizing that the best way to sell a home is to price it correctly so that buyers respond. Buyers are closely watching the market and are not willing to overpay for a home. Real estate has historically been a good hedge against inflation, and that will continue to work in the favor of the Hamptons real estate market.

Joe Fuer: When prices rise for everything, it motivates investors and buyers to invest in real estate, understanding that real estate has historically appreciated in value in the long term.

Elizabeth Bowden: Inflation is persistent, and while rates continue to rise, the overall demand remains significant.

Where does housing inventory stand in terms of meeting buyer interest?

Judi Desiderio: Excellent question, because that is what determines the price. The scales of supply and demand are the critical issue. As you know, I break down my market reports into 12 different market places, and several different price ranges within each of those markets. I do that because certain markets fare differently than others, and different price ranges get affected more so than others. Of course, at the lower end of the market, we know that inventory will never be replaced, so that there will always be greater demand and supply. Mid-markets, from $2 million to $8 million, seem to be more balanced, and the upper price categories may be seeing greater inventory than demand. Every market has its saturation point.

Todd Bourgard: Inventory has steadily risen, although it is still considered low. Today’s buyers seem more open to waiting for the home that checks most of their boxes, as they see more and more inventory hitting the market.

Sharon Stern: Inventories remain at levels that are relatively lower than in the past several years, when the Hamptons experienced record inventory absorption. The lack of inventory is impacting sales volumes from the record levels of the last few years. As a result, new listings, especially when fairly priced, are immediately considered and still far more quickly sold than would have been the case prior to COVID. Sellers recognize that this market still remains a strong one in which to sell, and educated buyers understand value and more quickly recognize opportunity.

Gary DePersia: There is still not enough inventory in every price range and location. Buyers eager to buy are making decisions based on what’s there now or biding their time waiting for other inventory to surface.

Denise Rosko: We are still in a seller’s market. The mad rush may be over, but the number of available homes is still inferior to the number of buyers who would like a Hamptons homestead.

Cynthia Barrett: Inventory was at historic lows, which in turn significantly limited the choices of a homebuyer on the East End. The interest was here but not the inventory. Buyers were either shut out with the frenzy of bidding wars on the few new-to-market properties, or the buyers decided to wait. Now that inventory is slowly coming back into the market, existing inventory is sitting a little longer and prices have plateaued. I am seeing an increase in buyer interest.

Aimee Martin: Before COVID sent the Hamptons housing market into a buying frenzy, the Hamptons listing database of homes, land and commercial properties sat at around 6,000 listings. At its lowest point, there were only 1,100 listings available for sale (and 2,500 agents trying to sell them!). It’s no wonder there were bidding wars. As of last week, we’re up to almost 1,400 listings, so we’re going in the right direction. It’s been a slow and steady climb, with an increase of about 2 percent a week.

Joe Fuer: Currently, inventory is meager at best, and part of that is seasonality. I expect inventory to rise in the fall. Potentially, sellers who have been on the fence about selling may leap if buyer interest remains strong.

Elizabeth Bowden: Inventory continues to join the marketplace daily; however, it cannot sustain the demand.

Are COVID variants and potential shutdowns and travel restrictions still on buyers’ minds?

Judi Desiderio: Actually, once the world opened up, many people chose to spend their summers abroad — take that vacation they wanted to take for two years. That negatively impacted our rental season, in addition to the fact that many of our tenants became buyers over the last two years. Most people are COVID exhausted.

Todd Bourgard: Based on open venues, packed concerts and stadiums, travel demand at an all-time high and more, I would say the concern of COVID variants are not at the forefront of the buyers’ minds right now.

Sharon Stern: COVID appears to be with us to stay, and potential shutdowns and travel restrictions appear to be of less concern. For many, some travel is back, but purchasing a home is still on the table. In my opinion, this change in attitude has had a much greater impact on the present rental market than on the sales market. If anything, the fact that COVID remains in the picture is still a catalyst for buying.

Gary DePersia: I’m not hearing much about that. People seem to be back to doing what they did before.

Denise Rosko: I believe we will never fully be rid of COVID and should respect each person’s approach to protecting themselves.

Cynthia Barrett: Buyers, for the most part, have adapted and incorporated COVID variants, potential shutdowns and travel restrictions into their “new normal.” Life goes on.

Aimee Martin: Despite new variants, I think COVID is on the back burner of people’s minds. Everyone wants to get on with enjoying their lives, because COVID taught us that life is short. Westhampton Beach (and all the villages and hamlets in the Hamptons) are thriving this summer. Westhampton Beach Village is better than ever, and Main Street is busy with people enjoying restaurants, great retail shops, wonderful beaches and a world-class performing arts center.

Joe Fuer: While many are still careful and will wear masks while visiting properties indoors, COVID is no longer a primary driver of the real estate market.

Elizabeth Bowden: At this point, many have the out of sight, out of mind mentality.

What other factors are at play that aren’t being talked about enough?

Judi Desiderio: International buyers have pretty much been nonexistent on the East End — and that’s unfortunate, because they did always play a 10 to 15 percent role. Investments such as bitcoin and other tech stocks that have lost 75 percent or more of their value are of concern, because the retail investor dove in headfirst. So we are yet to see the impact of that. It reminds me of the dot-com bubble that burst in 2000. It’s a specific segment of buyers and sellers.

Todd Bourgard: An exciting and important topic is that people are traveling globally again. With the Hamptons being a world-class destination for the most discerning travelers, this surge is wonderful for the local economy. Our restaurants, shops, hospitality venues and, of course, real estate all benefit from people visiting our area.

Sharon Stern: The frantic urgency in the market is abating. Real estate is going back to basics. For sellers, this means that buyers are becoming more selective. The newer, cleaner, fresher and maintained the property is, the better. Condition and amenities matter, and preparing a property for sale, practically and legally (with updating surveys, for example), is important in order to command top price. Buyers, on the other hand, should be prepared to move quickly. Being prepared financially, with sources of payment at the ready, is key. Knowing what a seller needs in terms of timing is also important. Meeting the objectives of the seller and keeping the deal as easy, simple and clean as possible is the best path forward to a successful transaction. If possible, be prepared to make an all-cash offer (no financing contingencies) quickly, and be ready to move ahead and sign a contract as quickly as possible.

Gary DePersia: The fact that some people are leaving New York State for a primary residence in Florida, because of tax reasons, bodes well for the Hamptons. In the summer, they will really want a place here for three or four months before they have to go back.

Denise Rosko: One of the things that may not be very apparent at the outset of a purchase is that our infrastructure here on the East End is bursting at the seams. Getting things accomplished by way of renovations, reconstructions or new homes on vacant land will require time, as our municipalities have their hands full trying to accommodate all the work that homeowners and developers are planning.

Cynthia Barrett: Now that more people are here in the Hamptons, Shelter Island and the North Fork, we have a responsibility to make our communities better, keep our beaches clean and be aware of our impact on the environment to ensure our community remains one of the most beautiful areas in the world.

Aimee Martin: When looking at the Hamptons real estate market, I think it’s important to recognize that the 2022 real estate market is not in trouble, despite numbers being down. It’s still a great time to buy and a great time to sell. And I do think the topic of affordable housing needs to be better addressed — and solved — so our young residents and all the local workers who sustain our villages and hamlets can live and thrive here.

Are bidding wars still common?

Judi Desiderio: Again this is specific to the location and the price range, I would say it mostly occurs below $2 million than any other price range.

Todd Bourgard: We are still seeing multiple offer scenarios as a very common factor in our area. The right product at the right price will always draw more than one interested party. In fact, we’re seeing that one out of every three homes enters a multiple bid situation.

Sharon Stern: The best indication that a property is fairly priced is the bidding wars that are still occurring. Although not as common as during the most heated period in the market, the bidding war remains with us. Buyers should be keenly aware that there is significant unmet demand and are well advised to move quickly and strongly to secure the properties they want to purchase. Chances are that if you like a property, so will someone else. Sellers should also be aware, however, that unlike during the height of the pandemic, properties which appear overpriced are not as quickly absorbed, and we are beginning to see some price reductions.

Gary DePersia: There are definitely still bidding wars. Those will increase as buyer interest grows in August and September.

Denise Rosko: Yes, we are still experiencing multiple bids and over-ask offers. A combination of low inventory, excess buyers, and advanced access to information and technology is resulting in a mass of informed buyers who are ready to commit when the conditions are right. A home that hits the market at, or under, current value will attract those buyers and could result in multiple over-ask offers. The initial introduction and marketing are very important!

Cynthia Barrett: Bidding wars are still happening, although not as often as at the height of the pandemic. Homes priced very well (especially in the less than $3,000,000 price range) are more likely to receive multiple offers. The number of bidders/buyers and offers are less now.

Aimee Martin: Yes, but not as often as during COVID. The reality is that any seller who prices their home just below market value will see increased showings and is more likely to get multiple offers and bidding wars, especially in the under $1.5 million market.

Joe Fuer: Bidding wars are less frequent than they were at the height of the pandemic. However, if a property is priced well, it will see multiple offers.

Elizabeth Bowden: While bidding wars are not nearly as prevalent as they were on the pandemic days, they have not disappeared entirely.

What is your real estate outlook for the rest of the year?

Judi Desiderio: The second half of 2022 may feel like we just took the exit off the Autobahn moving from 90 mph to 50 mph. But those who sat on the sidelines waiting for prices to adjust and opportunities to arise will enjoy that next wave in our marketplace.

Todd Bourgard: My outlook is one that is steady and strong. The Hamptons is a beautiful place to live and historically has always been a great place to invest.

Sharon Stern: There are three principal factors impacting my outlook for 2023. First, unmet demand will continue to drive the market as buyers who have remained on the sidelines continue to look for property. I am finding that buyers are prepared to move forward on fairly priced properties as their buying decisions are driven by life events and value rather than the financial markets. The second factor is that buyers are now sensing that the pendulum is now beginning to swing in their favor. Over the last two years, sellers have had the upper hand. With the pace of sales and the urgency in the market slowing, buyers are looking even more carefully at pricing. A balanced market means that now, more than ever, working with an experienced broker to represent you is critical to a successful transaction, whatever side you are on. Finally, I am expecting pricing to stabilize and cannot yet comment on the extent we will see increases in inventory — I certainly hope so.

Gary DePersia: With increased inventory, coupled with stable prices, and ample buyers still looking to buy, my view is you’re going to see a lively market for the balance of the year.

Denise Rosko: We foresee a strong finish to the year and look forward to working with and welcoming all our new neighbors.

Cynthia Barrett: The market outlook for the remainder of the year will be more normal, at parity, where there are an equal number of buyers and sellers. More thought will go into purchasing and selling in the Hamptons. Buyers and sellers will be more rational in their decisions. The fall has always been the second best season to purchase or sell in the Hamptons and I expect this to happen again this year as homeowners who have rented out their homes or did not get a renter this summer decide to sell. The fall market will give both the buyer and the seller opportunities. The ultra high-end luxury buyer will continue to invest in high-end real estate as they have in recent years. The Hamptons market and price activity looks like a stairway where there is a plateau then a spike upward, then another plateau, maybe a slight dip along the way, and then up again.

Aimee Martin: Positive. I primarily sell in the west of the Canal market (Hampton Bays to Remsenburg, with an emphasis on Quogue and Westhampton Beach). Here, the under-$3 million market is most in demand and it usually takes longer to sell the higher-end homes. I recently listed a waterfront home in Quogue for $10.95 million and was encouraged to see how quickly it went into contract, with great interest from high-end buyers. Again, it goes back to real estate being a good hedge against inflation. The Hamptons market will always be in demand.

Joe Fuer: This is still a solid market, and I remain optimistic. Many investors who purchased over the past two years and did not realize their anticipated rental income will look to offload their assets.

Elizabeth Bowden: The Hamptons marketplace is formidable, arguably one the most formidable in the world. I anticipate the balance of Q3 to hold its course, gain momentum through Q4 and into the New Year. A word to the wise: The Hamptons real estate market, like other markets, will experience ups and downs; however, this one in particular always comes back roaring.